In the banking compliance world, a picture is not worth a thousand words.

When oversight of fintech-banking partnerships, now in the crosshairs of bank regulation risk management, is limited to single snapshot moments in the relationship, like due diligence at the start or recertification on the back end, it leaves a majority of customer interactions unmonitored, leaving bankers open to compliance, operational and reputational risks. This article identifies this gaping hole in bank compliance monitoring and offers recommendations. How can you ensure your banking compliance department is ready for regulatory agencies?

Banking regulations and compliance + fintech partnerships

Financial institutions have embraced fintechs, after initial reluctance, in the hopes of accelerating digital transformation. Generally, these banking-fintech partnerships have expanded the value financials offer customers, but they’ve also drawn the attention of regulators, who are understandably scrutinizing these relationships.

What was meant to propel digital transformation has also added a layer to compliance management in an already intensely regulated industry.

If monitoring and controlling third-party risk is difficult, add in the oversight of fourth-party risk, which comes from the service partners that third-parties contract with to fulfill their own offerings. What a tangled web of ecosystem providers to monitor.

Regulatory agencies are not deeply sympathetic to this complexity, stating plainly that banks own every interaction on their value chain, even when external service providers are delivering them.

Bank compliance teams apply fewer resources when risk is high

Ensuring your partner ecosystem is complying with regulators and with your service level agreements is a big lift. However, research shows banks don’t put as many resources towards monitoring risks at the critical points when things go awry most often.

Gartner reports only 27% of a financial institution’s risk management function focuses on identifying risks during the ongoing relationship with the partner.

Due diligence and recertification of the partnership receive the lion’s share of the enterprise’s attention. These leaders also admit that 83% of identified risks occurred smack dab in the middle of those bookends - during the ongoing relationship - with 31% leading to a “material impact.”

Traditionally, 73% of effort devoted to risk identification is allocated to due diligence and recertification efforts, with only 27% of effort allocated to identifying risks over the course of the relationship.

It is not clear whether the identified risks were compliance gaps or operational blow-ups. What is clear is that if 8 of 10 risks emerge during normal operations of the ecosystem, there’s a gaping hole in real-time monitoring.

Why are so many incidents with partners going unnoticed by financial institutions? It’s actually not difficult to understand.

73% of bank regulation risk management resources are applied to two snapshots in time with a partnership: during due diligence as the bank and its partner prepare to kick off the collaboration and then again at recertification. Just over a quarter of the resources are left to monitor whether the partner is complying with bank regulations in day-to-day interactions with customers.

Stale Data Hides Third-Party Partnership Risk

Snapshots in time won’t fully identify problems in daily operations. In addition, partner organizations are not static, and they can make changes that affect the relationship and how they deliver service to bank customers. In most cases, the financial institution has no natural visibility into what’s happening with partners in the moment because of data silos and disconnected teams that don’t share information in real time.

Examples of third-party changes that can introduce bank compliance risk:

- Expanding scope of work from initial agreement

- Updates to partner platforms and processes

- Changes in a partner’s personnel and/or leadership

- Pivots in a partner’s business strategies

- Technology enhancements

Any one of these can impact partner delivery within the value chain. Left unmonitored, the financial institution may be entirely unaware, however, until something goes wrong.

Real-time Partner Data Strengthens Banking Service Governance

Gartner recommends an iterative approach to managing your partnerships service delivery, meaning spend more resources on ongoing operations instead of just the bookends. By putting more attention on service governance as it happens, financial institutions can see and prevent problems before they become regulatory enforcement actions.

Three ways to use data to enhance bank compliance and monitoring

1. See all interactions in your ecosystem

Peter Drucker famously said, “What gets measured gets managed.” Since legacy systems can’t deliver full ecosystem visibility well in real-time, banks must find other ways to augment and empower bidirectional data sharing between ecosystem stakeholders.

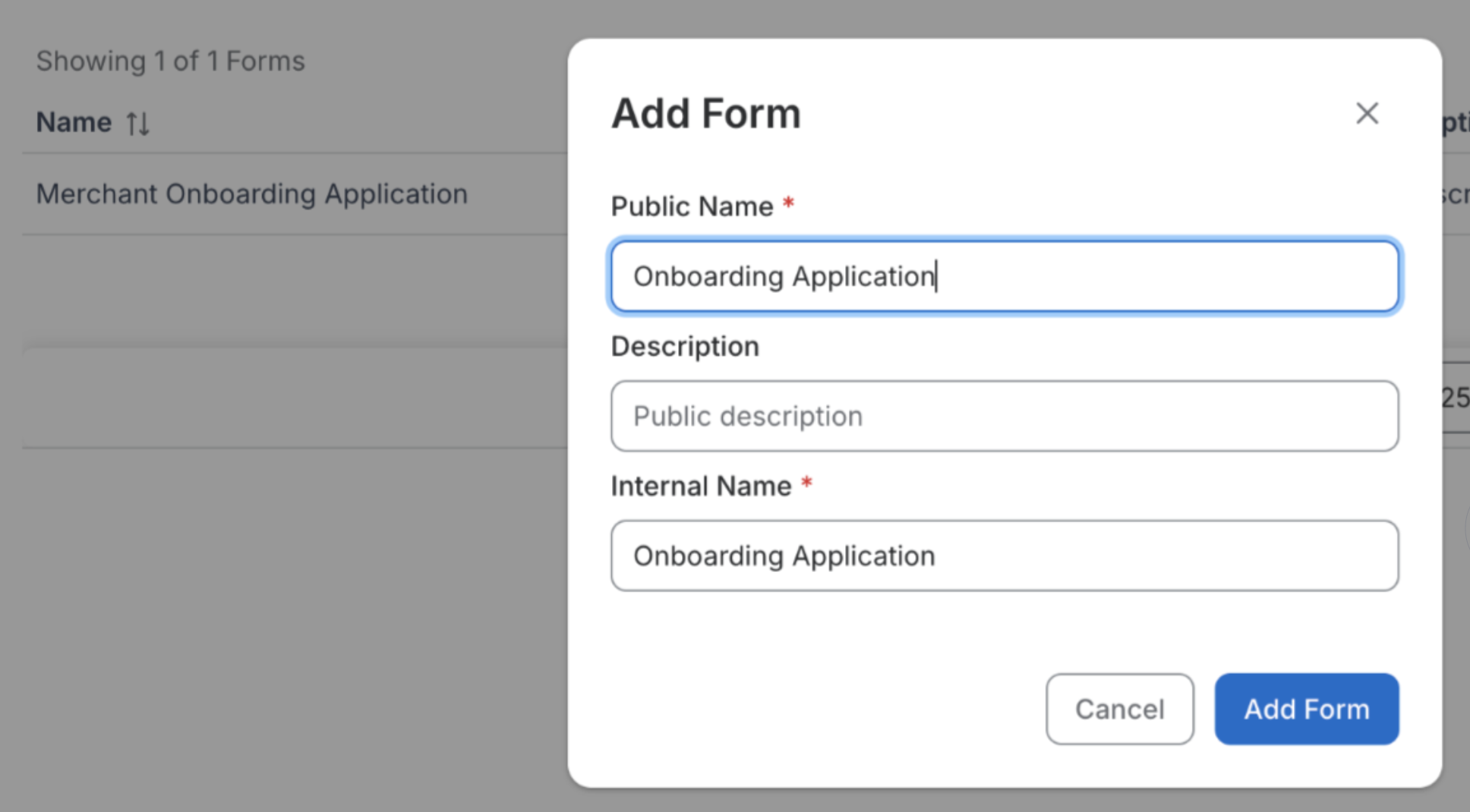

OvationCXM experienced this; we were founded as a technology support provider in a complex payment ecosystem. Our connector network was built to solve the lack of visibility we had into our shared customer.

We created pre-built connectors into ecosystem platforms and threaded together the customer information. Once we could see all of the journey steps a customer was taking from beginning to end; where they were in that journey at any moment; and their past and ongoing interaction details, we finally had context into the entire relationship and could provide more personalized, exceptional service.

Connecting an ecosystem using connectors to break down data silos is a fast, foolproof way to harmonize all of your customer interaction and operational data, making it easier to monitor whether everyone is complying with regulatory standards before issues escalate into formal complaints or larger enforcement actions.

2. Identify compliance issues immediately

Outdated data pulled from a single point in time doesn’t accurately capture the health of the third-party partnership. Relationships are dynamic, therefore, the data used to evaluate and monitor those partnerships must be too. Having access to dashboards that highlight key metrics at a glance from the ecosystem provides bank compliance teams with instant views into the daily state of CX delivery. Nothing is a surprise, so emerging problems can be addressed early.

3. Learn from AI-powered insights

Once banks have connected ecosystem data as it happens, they can leverage AI to identify trends and irregularities for them in a partner’s CX. The ecosystem connectors also pull in more operational and experience data sources, which gives AI greater fuel to deliver never-before-available insights on trends and red flags, long before they become obvious.

Bank compliance questions answered through AI insights:

- Are certain journey steps taking too long?

- Are there more customer contacts during certain stages? Does this suggest communication breakdowns?

- Are clients abandoning journeys at higher rates during certain steps? With certain partners?

- Are partners meeting SLAs and if not, where is the breakdown?

When banks have third-party visibility on demand, they can get answers and address concerns immediately, instead of waiting for recertification.

Real-time bank compliance data: It pays off

Compliance is a necessary expense for financial providers. But it can actually power better financial results when banks shift to a proactive service governance strategy for their ecosystem instead of putting most resources toward bookends in the relationship. According to Gartner’s research, business outcomes are improved with this iterative approach.

According to the analyst, “Businesses that use an iterative approach indicate business partners are three and a half times more satisfied with the business’s ability to quickly engage with third parties, twice as satisfied with their ability to remediate third-party risks before they have a potential impact, and one and a half times more satisfied with the ability to surface third-party risks before they are too late to remediate.”

In other words, business lines and partners are happier because relationships can be launched more quickly with agility. They are also happier with the ability to remediate risks more quickly and identify risks before it’s too late to remediate at all.

Ecosystem connectors: Fastest way to connect banks to their ecosystem

Fintech partnerships will continue to drive innovation, helping to overcome legacy systems and hard-coded, cookie-cutter customer experiences. Cornerstone Advisor’s latest What’s Going On in Banking report for 2024 confirms that 70% of banks and 80% of credit unions remain bullish on using fintech partnerships to drive growth.

That means organizations must invest in the systems that will power consistent and compliant delivery of service experiences to shared customers and capture and document compliance across the value chain.

About OvationCXM

OvationCXM’s unique CX technology is this sophisticated engine. It has a built-in network of connectors to the platforms banks use daily, from Fiserv to FIS to Salesforce, so it can dismantle data silos, even hardened ones like a bank core, to unify customer information across third- and fourth-party vendors in one place. Once aggregated, this service provider ecosystem data makes it easier to see and manage third-party CX, monitor and document compliance, and fuel artificial intelligence insights and automation.

See OvationCXM’s technology in action.

Learn how one bank using OvationCXM has achieved 75% greater service visibility, which has streamlined operations, reduced operating costs and let them own the entire customer journey.

.svg)